INTRODUCTION

The cryptocurrency landscape is always evolving, and 2024-25,promises to bring some of the most exciting changes yet. From the growth of decentralized finance (DeFi) and smart contracts to eco-friendly blockchain solutions, the future trends in cryptocurrency market is on the brink of significant transformation. This guide will provide an overview of the key trends to watch in 2024-25 and how these trends may reshape digital finance.

1. What is Decentralized Finance (DeFi)?

- What is DeFi? Decentralized Finance, or DeFi, uses blockchain technology to remove intermediaries in financial transactions.DeFi stands for Decentralized Finance and means financial services without banks. DeFi allows people to borrow, lend, and trade using cryptocurrency instead of traditional banks.

- Growth Areas: DeFi has been expanding rapidly and offers new protocols that allow users to borrow, lend, and trade directly without traditional banks.

- Passive Income: Investors can earn by “staking” or lending their cryptocurrency.

- More Users: DeFi is growing because it’s easier and often cheaper than using banks.

- Impact on Cryptocurrency Holders: By the end of 2024, more accessible DeFi solutions are likely to emerge, making it easier for cryptocurrency investors to access DeFi tools and potentially earn passive income.

How It Helps Cryptocurrency Investors

In 2025, we will see more simple tools for DeFi. This makes it easier for people to earn passive income from their crypto.

Examples of DeFi Applications

- Lending and Borrowing: DeFi platforms like Aave and Compound allow users to lend their assets for interest.

- Decentralized Exchanges (DEXs): Platforms like Uniswap let people trade cryptocurrencies without a middleman.

2. Institutional Adoption and Government Involvement

- Why Institutions are Interested: Large financial institutions are showing a growing interest in cryptocurrency. Reasons include increased security, lower fees, and the potential for high returns.As cryptocurrency gains popularity, big companies and governments are also joining the trend.

- Lower Fees: Sending money with cryptocurrency can be cheaper.

- New Investment: Some companies see it as a new way to grow their money.

- Government Initiatives: Governments worldwide are also taking notice, some even creating central bank digital currencies (CBDCs).

- What This Means for Investors: As institutions and governments adopt digital currencies, the credibility and stability of cryptocurrency could increase, leading to wider acceptance.

How Big Companies Use Cryptocurrency

Many large corporations, like Tesla and MicroStrategy, have already invested in Bitcoin, and we can expect more companies to join in 2024. They are interested in cryptocurrencies

What About Governments?

Some governments are creating central bank digital currencies (CBDCs). These are official digital versions of money, like a digital dollar.

3. Better Technology for Blockchain

Blockchain is the technology behind cryptocurrency. In 2024-25, we’ll see big improvements in how it works.

- Layer 2 Solutions: Ethereum’s Layer 2 solutions, such as Optimistic Rollups and zk-Rollups, aim to solve scalability issues.: These are updates that make blockchains faster and cheaper.

- Interoperability: New protocols like Polkadot and Cosmos are making it easier for blockchains to communicate, paving the way for multi-chain ecosystems.

- Potential Impact: These advancements could lower transaction fees, increase speed, and offer more versatile applications across industries.

What This Means for Cryptocurrency

Better technology means lower transaction fees and faster payments, making crypto more useful for everyone.

4. Eco-Friendly Cryptocurrencies and Green Mining

Some cryptocurrencies, like Bitcoin, use a lot of energy. But in 2025, many projects focus on being eco-friendly..

- Environmental Concerns: Bitcoin’s energy consumption has raised sustainability issues.

- New Eco-Friendly Cryptos: Cryptocurrencies like Chia and Cardano use less energy-intensive consensus mechanisms.

- Lower Energy Use: Eco-friendly cryptocurrencies are better for the environment.

- Future Outlook: The trend toward sustainability could drive eco-friendly projects, making these cryptos more appealing to environmentally conscious investors.

How It Helps Investors

More people may invest in eco-friendly cryptocurrencies because they’re better for the planet.

5. NFTs: Expanding Beyond Art and the Evolution of Digital Ownership

NFTs (Non-Fungible Tokens) are unique digital assets. In 2025, NFTs are expanding beyond art into new areas.

- Beyond Art and Collectibles: Non-fungible tokens (NFTs) are expanding into gaming, real estate, and intellectual property.

- Potential for New Markets: NFTs may also open up new markets in licensing and royalties.

- Investment Potential: As NFTs grow, they could represent diverse assets, providing investors with unique opportunities to participate in new markets.

How NFTs Affect the Market

NFTs may become part of real estate, music, and gaming, creating more ways for people to earn money.

6. Stronger Security and More Regulation

As cryptocurrency becomes more popular, security and regulation are improving.

- Rising Need for Security: As more users join the crypto space, security is a top priority to protect against hacks and fraud.Cryptocurrency markets have had issues with hacks and fraud. Improved security protects investors.

- Enhanced Regulations: Regulatory agencies in various countries are imposing stricter rules, and by 2024, we may see a global regulatory framework.

- What This Means for the Market: Better security and regulation could lead to more stable and secure cryptocurrency markets.

New Regulations for Safety

Governments are adding rules to make cryptocurrency safer. In 2025, new laws could protect investors from risks.

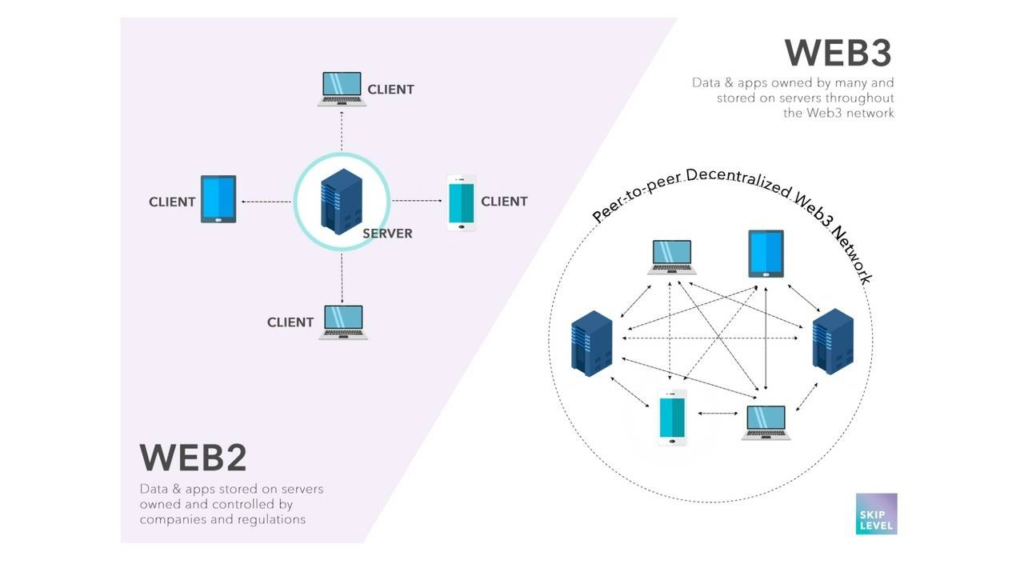

7. Web3 and Decentralized Apps (dApps)

Web3 is a new version of the internet where users own their data. Decentralized apps or dApps are built on this idea.

- What is Web3? Web3 represents the third generation of the internet, focusing on decentralization and user control over data.

- No Middlemen: dApps don’t rely on big companies like Facebook or Google.

- Privacy: Users keep control of their information.

- Growth of dApps: Decentralized applications powered by blockchain could transform social media, finance, and gaming.

- Long-Term Impact: As Web3 grows, users may become less reliant on centralized platforms, changing the landscape of online interactions and digital finance.

What Web3 Means for Cryptocurrency

As Web3 grows, more people may use cryptocurrency to power these dApps, creating more demand for crypto.

8. Stablecoins and Central Bank Digital Currencies (CBDCs)

Stablecoins are cryptocurrencies with a fixed value, like $1. In 2025, stablecoins and central bank digital currencies (CBDCs) will likely grow.

- Understanding Stablecoins: Stablecoins like USDT and USDC offer price stability by pegging to fiat currency.Lower Risk: They’re not as volatile as other cryptos.

- Everyday Use: Stablecoins can be used like regular money.

- CBDC Development: Central banks globally are exploring their own digital currencies.

- Implications: The growth of stablecoins and CBDCs might stabilize the market, making cryptocurrencies more viable for everyday transactions.

CBDCs by Governments

Some governments want to create CBDCs, like a digital euro or digital dollar.

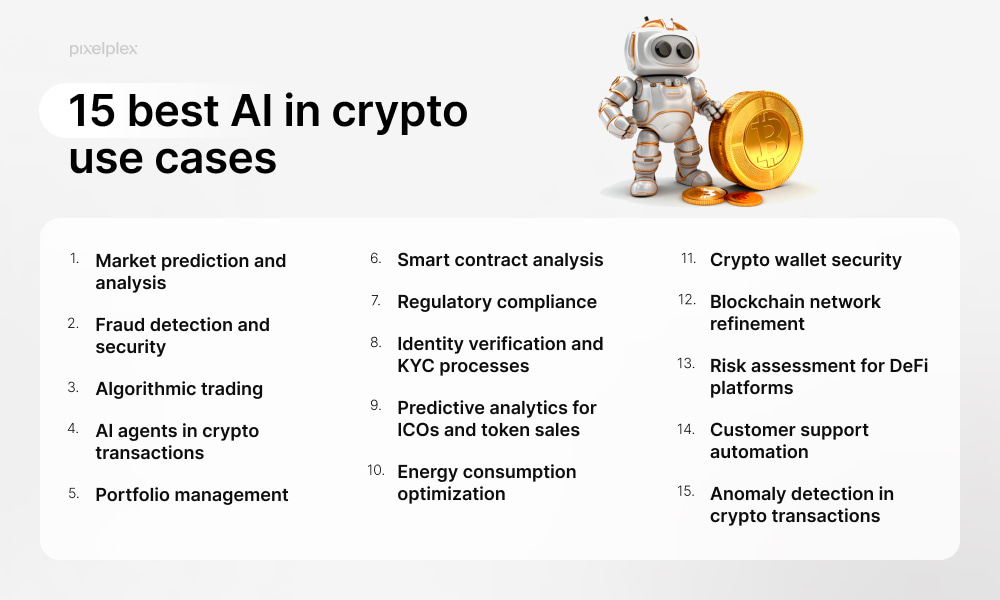

9. AI in Cryptocurrency Market Analysis

Artificial Intelligence (AI) is helping people make better choices with cryptocurrency.

- AI-Powered Trading: Artificial intelligence is being used to predict trends and optimize trading strategies.

- Impact on Investors: By integrating AI, investors can make informed decisions, potentially increasing returns and reducing risks.

- Trading Bots: AI can help find the best times to buy or sell.

- Risk Management: AI tools can reduce the chances of making risky choices..

What AI Means for Investors

AI makes it easier for new investors to start with cryptocurrency.

10. Cryptocurrency and the Metaverse

The metaverse is a virtual world where people can interact and buy virtual items.

- What is the Metaverse? A digital universe where people can interact, play, and conduct transactions virtually.

- Role of Crypto in the Metaverse: Cryptocurrencies may serve as the primary form of currency in these virtual spaces.

- Future Possibilities: As the metaverse expands, crypto could become the backbone of digital economies, providing investment opportunities.

- Digital Purchases: Cryptocurrencies can be used to buy items in the metaverse.

- Investment Potential: As more people join the metaverse, there could be more demand for cryptocurrencies.

Future of Cryptocurrency in the Metaverse

The metaverse could create new markets for crypto, allowing investors to benefit from this virtual world.

Conclusion: The Future of Cryptocurrency in 2024-25

2025, will bring new and exciting trends in cryptocurrency. From DeFi and NFTs to AI tools and Web3, these trends offer new ways to invest and use cryptocurrency. Keeping an eye on these developments will help you make the most of what,’The year 2025 is poised to be transformative for the cryptocurrency sector. From DeFi and eco-friendly blockchain solutions to government involvement and advancements in blockchain technology, the future holds great potential. For investors and enthusiasts alike, staying informed and proactive will be key to navigating these trends successfully.s to come.

Cryptocurrency is constantly changing, and 2025 promises exciting new trends. If you’re curious about where cryptocurrency is headed, this guide will walk you through the major future trends in cryptocurrency and what they mean for investors. From DeFi and NFTs to AI integration and the growth of the metaverse, each trend is set to reshape the digital finance world.