INTRODUCTION

CRUPTOCURRENCY INVESTMENT : A BEGINNER’S GUIDE

Cryptocurrency investment involves Buying,Selling,and Trading Currencies like Bitcoin,Ethereum and others .These currencies exist only online and use cryptography for secure Transactions . Cryptocurrency is a digital or virtual currency that uses cryptography for secure transaction.it operates independently of central banks and goverments, making it a Decentralized system.

WHY INVESTMENT IN CRYPTOCURRENCIES?

- Potential for High Return

- Diversity your investment portfolio

- Growing Demand and adaption

- Decentralized and secure Transactions

- Transparent

- Limited supply

- secure

- Digital

WHAT IS CRYPTOCURRENCY INVESTMENT?

Cryptocurrency investment involves Buying,selling,and Trading Digital currency ,such as Bitcoin,Ethereum,and others with the Goal of generating returns through price appreciation or Dividends.

Cryptocurrency has transformed the financial landscape ,offering a new asset class and payment system ,while challanges persist ,the potential benefits and future prospects make cryptocurrency an exciting and rapidly evolving space.

Difference From Traditional Investment

- Assest Class – Cryptocurrencies are a new assest class ,Distinct from stocks bond and commodities.

- Decentralized – No central Authority controls transaction or issuance .

- High volatility – Cryptocurrency prices can change rapidly.

- 24/7 TRADING- Cryptocurrency markets operates continously.

MAJOR CRYPTOCURRENCIES:

- 1 = BITCOIN (BTC) : First and Largest cryptocurrency by Market Capitalization.

- 2 = ETHEREUM ( ETH) : Second largest cryptocurrency .enabling smart contracts and decentralized applications.

- 3= ALTCOINS : Alternative cryptocurrencies, such as Litecoin (LTC) , Bitcoin cash ( BCH) ,and Cardano (ADA).

- 4 = TOKENS ( ERC-20 tokens )

- 5=STABLECOINS( e.g. – USDT,USDC)

BENEFITS OF CRYPTOCURRENCY

- 1= POTENTIAL FOR HIGH RETURN = (a) High growth potential due to increasing adoption and demand .

- (b) Some cryptocurrencies have shown significant returns in the past .

- (c)Potential for long term appreciation.

- 2 = DIVERSIFICATION= (a) Reduces portfolio risk and increase potential returns .

- (b) Cryptocurrencies are uncorrelated with traditions assests ( stocks,bonds,commodities).

- 3= DECENTRALIZED AND SECURE =(a) Blockchain technology ensures secure ,Transparent and Tamperproof transaction.

- cryptocurrency transactions are private .

- 4= LIQUIDITY= (a) 24/7 trading and accessibility

- Global Market Access

- Easy conversion to Flat currencies.

- 5= LOW TRANSACTION FEES = (a) compared to traditional payment system ( credit cards, banks) .

- Fast and efficient transaction processing .

- Reduced Costs for international transaction.

- 6= ACCESSIBILITY= (a) Anyone with internet access can invest .

- No geographical restrictions .

- Democratization of investment opportunities.

- 7= TRANSPARENCY = (a) Blockchain technology provides real time transaction visibility .

- Transparent ledger ensures accountability .

- Reduced risk of fraud and manipulation.

- 8= INNOVATION AND DEVELOPMENT = (a) cryptocurrency investment supports innovation and development .

- New technology and use cases emerge .

- Potential for groundbreaking discoveries.

- 9= TAX BENEFITS = (a) Tax advantages in some jurisdictions ( Capital gains exemptions) .

- Potential for tax deffered growth .

- consult a tax professional for specific guidence .

- 10= GROWING ADOPTION = (a) Increasing institutional investment .

- Mainstream acceptance and integration. ( e.g. PayPal , Visa ).

- Growing deamand and user base .

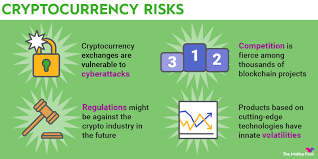

RISK ASSOCIATED WITH CRYPTOCURRENCY

Cryptocurrency investment carries various risks that can impact investment value .understanding these risks is crucial for making informed decisions.

- Market Volatility Risk

- Regulatory Risk

- Security Risk

- Liquidity risk

- Market Manipulation Risk

- Counterparty Risk

- Operational risk

- Reputation risk

- Scalability risk

- Enviormental risk

- Legal risk

- Tax risk

- Custody risk

- Technolgy risk

- Human error risk

TO MINIMIZE RISK, CONSIDER:

- Diversification

- Research and due diligence

- Risk management strategies

- Regular portfolio rebalancing

- Staying informed about market developments.

BEST PRACTICE FOR INVEST IN CRYPTOCURRENCY

- Use reputable exchange and wallets .

- Enable two -factor authentication.

- Store private keys securely.

- Monitor transactions and accounts regularly.

- Stay up to date with regulatory changes.

CRYPTOCURRENCY MARKETS : Cryptocurrency markets are platforms where investors Buy , Sell and Trade Cryptocurrencies.

TYPES OF CRYPTOCURRENCY MARKETS:

1 = EXCHANGE- BASAED MARKETS- Centralized platforms matching Buyers and sellers ( e.g. Binance, Coinbase ) .

2 = OVER-THE -COUNTER (OTC ) MARKETS- Decentralized plartforms for large transactions. (e.g. OTC desks) .

3= DECENTRALIZED EXCAHNGE (DEXs)- Peer to peer platforms using smart contracts ( e.g. Uniwap)

4= CRYPTOCURRENCY BROKERS- Intermediaries facilitating transactions( e.g. Robinhood).

REGULATORY ENVIRONMENT

The Regulatory enviornment for cryptocurrency is complex and evolving Here’s an overview-

REGULATORY CHALLENGES =

- 1 Lack of clarity and consistency .

- 2 Jurisdictional uncertainty.

- 3 Balancing innovation with consumer protection.

- 4 Combating illicit activities ( AML/CFT).

REGULATORY FRAMEWORK =

- Know your customer ( KYC ) and Anti – Money Laundering ( AML) regulations.

- Securities laws ( e.g. Howey test )

- Commodities Laws .

- Payment services regulations.

- Tax laws and regulations.

REGULATORY TRENDS=

- 1- Increased scrutiny of cryptocurrency exchanges

- 2- Stricter AML/CFT Regulation

- 3-Growing recognition of cryptocurrency as a legitimate asset class

- 4- Emerging guidelines for initial coin offering (ICO’S)

- 5- Central bank issued digital currencies( CBDCs).

CHALLANGES AND OPPORTUNITIES

- Regulatory clarity / over regulation

- Balancing innovation with consumer protection

- Harmonization of global regulation

- institutional investment and mainstream adoption.

- Cryptocurrency potential for financial inclusion.

BEST PRACTICE FOR CRYPTOCURRENCY BUSSINESS

- 1 Compliance with AML/CFT regulation.

- 2- Implimenting KYC procedure .

- 3- Registering with relevent regulatory bodies .

- 4- Engaging with regulatory authorities.

CRYPTOCURRENCY INVESTMENT PLATFORMS

- 1 Exchanges ( Binance,coinbase )

- 2 Brokerage( Robinhood,eTORO)

- 3 Investment apps( Abra, Revix)

- 4 Cryptocurrency funds and ETFs

RESOURCES

- 1 – Cryptocurrency Regulation Tracker ( coindesk) .

- 2 – Regulatory Frameworks for Cryptocurrency ( PwC ) .

- 3 – Global Cryptocurrency Regulatory Landscape ( DLA PIPER) .

- 4 – Cryptocurrency and Blockchain Regulation ( Skadden)

- 5- International cryptocurrency Regulation ( OECD )

FUTURE PROSEPECTS OF CRYPTOCURRENCY INVESTMENT

Cryptocurrency investment has gained significant attention in recent years ,and its future cryptocurrency prospects look promosing .Here are some potential developments that could shape the industry:

- Increased Institutional investment Growing interest from institutional investors ,such as hedge funds and pension funds .

- Mainstream Adoption : Cryptocurrency integration into traditional financial system .

- Regulatory Clarity : Clear regualtion and guidelines from goverments.

- Improved infrastructure : Enhanced trading platforms ,wallets and custody solutions.

- Growing Demand : Increased demand from Emerging Markets.

- Global Digital currency : A single widely accepted digital currency .

- Universal Basic income ( UBI ) cryptocurrency enabled UBI imoplementations.

- Decentralized Autonomous organization : self sustaining decentralized entities.

- Artificial Intelligence integration : AI powerd trading and investment platforms

- Space Based cryptocurrency Mining : Mining operations in space

BEST PRACTICE FOR INVESTORS

- (a) Educate Yourself on cryptocurrency and blockchain fundamentals.

- (b) Set clear investment Goals and risk tolerance.

- (c) Manage Risk and consider professional advice and guidence

- (d) Stay Informed about market developments and regulatory changes

- (e) Diversify Your Portfolio across asset classes and cryptocurrency.

CONCLUSION

Cryptocurrency investment has a promising future with potential for significant returns,growth , and innovation ,However ,it’s essential to be aware of the challanges and Risks involved. Cryptocurrency investment A High Reward ,High Risk Opportunity.

KEY TAKEAWAYS:

- 1 = Cryptocuurency investment offers high growth potential ,but also involves substanial Risk.

- 2 = Regulatory clarity and mainstream adoption are crucial for long term success.

- 3 = Diversification ,education and risk management are essential for investors

- 4 = Blockchain technology has far – reaching implication beyond cryptocurrency .

- 5 = Institutional investment and innovation will drive future growth .

INVESTMENT OUTLOOK :

- Short term volatility is likely but long term prospects remain promissing .

- increased institutional investment and mainstream adoption will drive growth

- Emerging markets and developing countries will play a significant role .

- Regulatory clarity and compliance will shape the industry future.

Cryptocurrency investment offers a unique opportunity for growth and diversification ,but it’s essential to approch it with caution and informed decision -making ,As the industry continues to envolve,staying educated ,diversified and adoptable will be crucial for success.