Introduction

Cryptocurrency has taken the world by storm, with more people than ever looking to invest in digital assets. But the crypto market can be volatile and unpredictable, so one of the most effective strategies for new investors is portfolio diversification. In 2025, with more types of crypto assets and investment strategies available than ever before, diversification has become an essential approach to minimizing risks and optimizing potential returns.

In this guide, we’ll cover why diversification matters, the types of cryptocurrencies to consider, practical strategies for building a diversified portfolio, tools to track your assets, and common mistakes to avoid.

1. Understanding Portfolio Diversification in Cryptocurrency

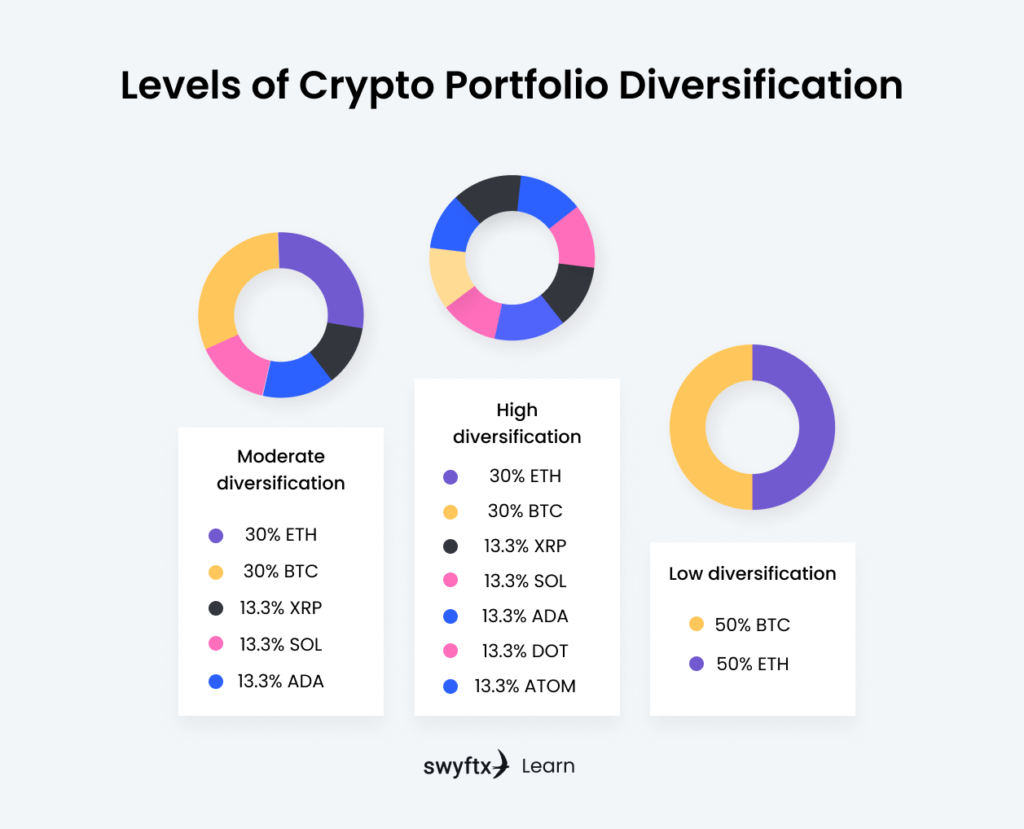

Portfolio diversification is a strategy that involves investing in a variety of assets to reduce overall risk. For crypto investors, diversification helps balance the portfolio by ensuring that losses in one asset can potentially be offset by gains in another.

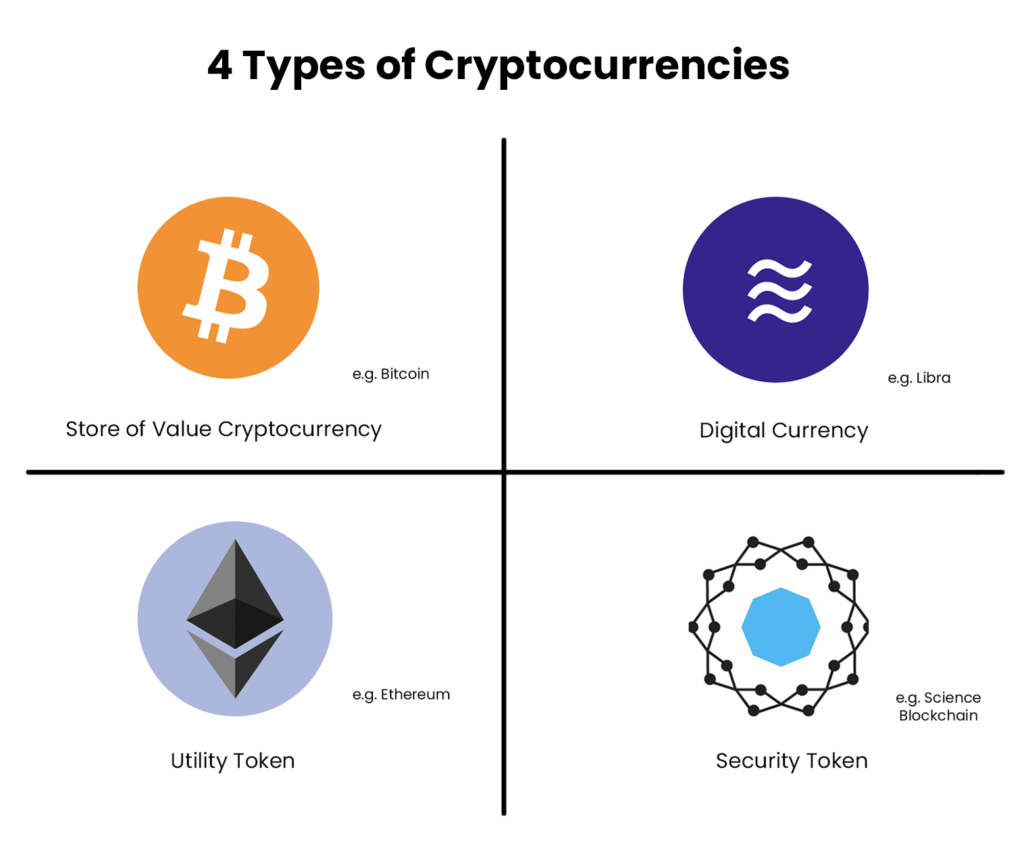

While a traditional stock portfolio might be built with an eye on factors like industry and geographic location, a crypto portfolio should consider the functionality and growth potential of each asset. Key types of crypto assets include major cryptocurrencies, emerging altcoins, stablecoins, and newer sectors like NFTs and DeFi. Each category has distinct characteristics, risk factors, and growth potential.

Key Concepts of Diversification:

- Asset Class Variety: Investing in various types of crypto assets.

- Sector Diversification: Allocating funds in different sectors, such as DeFi, gaming, and metaverse projects.

- Geographic Diversification: Including tokens from projects based in different regions can also reduce geopolitical risk.

Diversification isn’t just about minimizing losses; it’s also about maximizing growth by gaining exposure to multiple markets. The key is to understand which assets to include and why each holds a place in your portfolio.

Diversification in cryptocurrency can be different from traditional investments like stocks or bonds because crypto assets are more volatile. However, by selecting a mix of large, stable cryptocurrencies, altcoins with growth potential, stablecoins, and even newer digital assets, you can reduce the chance that a single market downturn will significantly impact your holdings.

2. Why Diversification is Essential in Cryptocurrency Investments

Risk Management

Crypto markets can be unpredictable, and prices can swing dramatically within minutes. Diversification spreads the risk across various assets, reducing your dependency on any single investment’s performance.

Navigating Market Trends and Volatility

Diversifying allows you to capture opportunities across various sectors in the crypto market, including DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and metaverse projects, among others. This helps your portfolio remain resilient even when specific markets experience volatility.

Expanding Growth Potential

The rapid evolution of the cryptocurrency landscape means new opportunities are constantly emerging. By diversifying, you can include assets that might have strong future growth prospects, giving your portfolio a balance of stability and potential upside.

3. Types of Cryptocurrencies to Include in a Diversified Portfolio

3.1 Large-Cap Cryptocurrencies

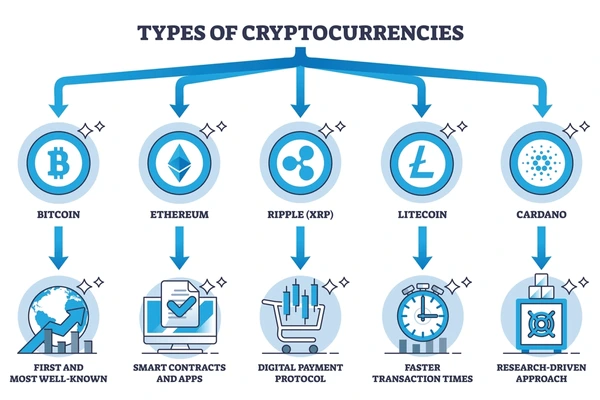

Assets like Bitcoin (BTC) and Ethereum (ETH) are the most established and widely recognized. They serve as stable anchors in a portfolio and tend to be less volatile compared to newer cryptocurrencies. Both BTC and ETH are often considered the “blue-chip” investments of the crypto world.

Bitcoin (BTC): As the first and most established cryptocurrency, Bitcoin is considered digital gold. It’s widely accepted as a store of value and has gained institutional support, making it less volatile than many other coins.

Ethereum (ETH): Ethereum’s blockchain technology enables smart contracts, making it the leading platform for decentralized applications (dApps), DeFi, and NFTs. Holding Ethereum offers exposure to the broader ecosystem of applications built on its network.

3.2 Altcoins with Growth Potential

Several alternative coins (altcoins) beyond Bitcoin and Ethereum have shown strong growth potential. Examples include:

- Solana (SOL): Known for its high-speed blockchain capabilities.

- Polkadot (DOT): Aiming to improve blockchain interoperability.

- Cardano (ADA): Focused on scalability and sustainability.

These coins are riskier than BTC or ETH but offer high upside potential.

3.3 Stablecoins

Stablecoins like Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) are pegged to traditional currencies, usually the U.S. dollar. These assets offer a safe haven during market volatility and serve as liquidity sources without needing to exit the crypto ecosystem.

3.4 Emerging Crypto Sectors: NFTs and Metaverse Tokens

Tokens associated with the NFT and metaverse ecosystems are increasingly popular. Projects like Axie Infinity (AXS), The Sandbox (SAND), and Decentraland (MANA) are at the forefront of this trend. While they’re volatile, they can diversify your portfolio by exposing you to fast-growing markets in virtual assets.

Uniswap (UNI): A decentralized exchange allowing users to trade tokens without a centralized exchange. It’s one of the leading platforms in the DeFi space.

Aave (AAVE): A decentralized lending protocol where users can lend and borrow cryptocurrencies.

3.5 Utility and Governance Tokens

Tokens like Chainlink (LINK), which powers decentralized data feeds, or Aave (AAVE), a DeFi lending platform token, offer unique use cases within the crypto space. They can add stability to your portfolio through their established utility in the decentralized finance ecosystem.

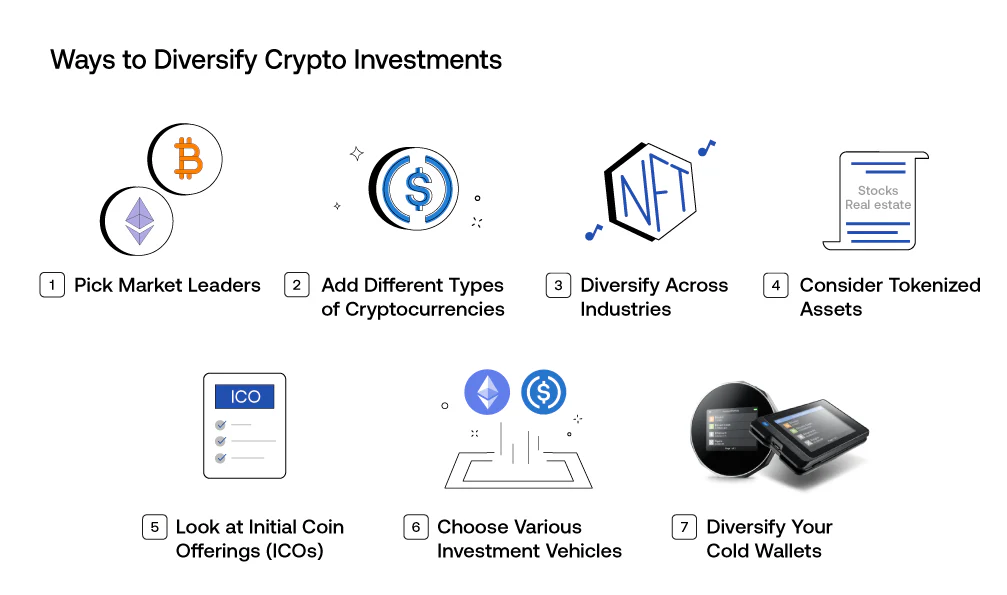

4. Strategies to Diversify Your Cryptocurrency Portfolio

4.1 Equal Weight Strategy

An equal-weight strategy involves investing an equal amount in each asset type, such as large-cap, altcoins, stablecoins, and emerging sectors. This provides a balanced approach without overemphasizing any single asset type.

4.2 Market-Cap Weighted Strategy

With this approach, you allocate funds based on the market capitalization of each cryptocurrency. For instance, you might invest more in Bitcoin and Ethereum and less in smaller altcoins. This gives your portfolio more stability by focusing on established assets.

4.3 Risk-Weighted Strategy

In a risk-weighted strategy, higher-risk assets (e.g., newer altcoins) receive smaller allocations, while stable assets (e.g., large-caps and stablecoins) have larger allocations. This approach is great for investors who want exposure to emerging projects while keeping most of their funds in safer assets.

4.4 Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of the market’s ups and downs. This strategy is effective for spreading out risk over time and can help reduce the impact of short-term volatility on your portfolio.

4.5 Periodic Rebalancing

Over time, the value of different assets in your portfolio will change. Rebalancing involves adjusting your allocations to maintain your initial strategy. For example, if Bitcoin’s value increases significantly, you might sell some BTC to reinvest in other assets, keeping your portfolio diversified.

5. Top Platforms for Managing and Tracking a Crypto Portfolio in 2025

5.1 CoinMarketCap

CoinMarketCap provides real-time data and alerts, helping investors keep track of various crypto assets’ performance. It offers comprehensive information on market trends, news, and asset rankings.

5.2 Blockfolio

Blockfolio is a mobile app that allows investors to track their portfolios, monitor prices, and get project updates. It supports a wide range of coins and is user-friendly, making it ideal for beginners.

5.3 Delta

Delta is known for its intuitive design and allows users to track multiple portfolios, set alerts, and receive insights on the crypto market. It also offers tax-tracking tools, which can simplify financial management for serious investors.

5.4 CoinTracker

CoinTracker offers portfolio management and tax-tracking features, ideal for investors looking to simplify tax filing. It integrates with many exchanges and wallets, making it convenient for users with diverse crypto holdings.

5.5 Zerion

Zerion is designed specifically for DeFi investors, allowing users to manage and track DeFi assets on the Ethereum network. It’s a great choice if you’re focusing on decentralized finance tokens.

6. Common Mistakes to Avoid in Cryptocurrency Portfolio Diversification

6.1 Over-Diversification

Investing in too many assets can dilute your portfolio’s growth potential and make it harder to monitor performance effectively. Aim to include a variety of assets but avoid spreading yourself too thin.

6.2 Ignoring Market Research

A key part of successful investing is staying informed. Failing to research assets thoroughly can lead to poor investment decisions. Make it a habit to stay updated on industry news and check the project roadmap of any asset you invest in.

6.3 Focusing Only on Popular Assets

While it may feel safer to stick with well-known assets like Bitcoin, newer or less popular assets with solid fundamentals can offer high growth potential. Diversifying beyond the top assets allows you to capitalize on emerging trends.

6.4 Neglecting Rebalancing

Crypto markets can be highly volatile, so regular portfolio rebalancing is crucial. If one asset performs very well, rebalancing allows you to lock in profits and reinvest them in assets that are underperforming or have growth potential.

6.5 Lack of Security Measures

Security is paramount in crypto. Many beginners overlook this, putting their portfolios at risk. Make sure to use wallets that offer strong security, consider hardware wallets for long-term holdings, and enable two-factor authentication on all accounts.

Conclusion

As a beginner in cryptocurrency, learning how to diversify your portfolio effectively is a key step towards achieving long-term success. A well-diversified portfolio balances stability with growth potential, helping to protect your investment from market swings. By focusing on a mix of large-cap cryptocurrencies, promising altcoins, stablecoins, and innovative assets like NFTs and DeFi tokens, you can build a portfolio that is both robust and positioned for growth.

Remember to use portfolio tracking tools to stay on top of your investments and to periodically rebalance to align with your goals. With these strategies in mind, you’re well on your way to navigating the crypto market confidently in 2025. Happy investing!